The local unit was relatively weak during the week, with dollar demand from offshore investors, energy and manufacturing firms outstripping existing supply from commodity exporters and remittance firms.

soledad

Stanbic Bank Uganda to provide full financing for Ugandans seeking to purchase residential houses

Ugandans hoping to live under their own roof and end renting have a new opportunity to do so with 100% financing from Stanbic Bank, courtesy of a new lending campaign dubbed “Oli Sorted” launched last week.

The 90-day campaign which targets the back-to-school season also enabled parents to borrow up to Shs 350 million in unsecured personal loans from Stanbic Bank, to support them pay school fees and other attendant expenses.

Speaking to the media this morning, Israel Arinaitwe, the head of Personal Banking at Stanbic Bank said the campaign is a timely response to address the needs of customers who require financing different aspirations in life.

“We are simply responding to what we hear and see from the feedback of our customers—they are tired of renting, they want to get more money, but they also want longer repayment tenures; so, we are responding in the affirmative through this campaign,” said Arinaitwe.

The campaign also covers the needs of business customers—those owning small and medium enterprises and seeking capital to restock or expand, according to Aaron Akampa, the head of Enterprise Banking at Stanbic Bank.

“Small and medium enterprises are the lifeblood of our economy—they employ millions and support the livelihoods of thousands of Ugandans. And they have been asking us to do more for and with them—they want access to quicker credit, they want to borrow at lower rates and safer options from moneylenders—Oli Sorted campaign is our response, and we invite all small businesses across the country to

visit any of our branches to get more information on how we can support them to grow their businesses,” said Akampa.

Both retail and business customers seeking credit in the next 90 days will benefit from the promotion offer of zero arrangement fees which means they get exactly what they apply for, without losing money in form of administrative processing fees often charged by banks.

“First of all, we are increasing the given under the previous campaign, to Shs 350 million in unsecured loans—we will not charge arrangement fees, and our decision will be given within 48hrs ensuring that no time is wasted,” said Salim Kitagenda, the head of Products at Stanbic Bank.

Kitagenda said while the Oli Sorted campaign targets Ugandans banking with Stanbic, customers currently working with other banks can be assisted to quickly open accounts with Stanbic and even transfer any loans with other banks and get to benefit from attractive offers.

SCHOOLS ARE SORTED

The campaign also targets schools— with parents who pay school fees through Stanbic agents and other channels such as FlexiPay standing a chance to win back up to Shs 500, 000 in cash back. Agents who process the most school fees payment transactions will also stand a chance to have their rent by the bank.

School administrators can also secure up to Shs 3 billion in operating capital to restock or construct new premises. Albert Yiga, the head of Education Sector Banking, said the campaign also comes with a variety of rewards for head teachers, bursars, school directors, parents, and teachers and Stanbic Agents.

The Cash-Back campaign has three broad brackets with rewards of insurance cover, school fees and rent refunds for agents. During the campaign, 45 schools will be awarded with insurance policies, numbering 90 in total.

“During the campaign, a total of 120 parents or students are potential winners. All they need to do is pay school fees through Stanbic platforms specifically FlexiPay, Schoolpay or through Stanbic agents to be considered eligible,” said Yiga.

In Category One (the top tier), schools that grow from the previous cycle average monthly collections by average balances of Shs 500 million (an equivalent of at least Shs 1.8 billion in collections) will win three policies (Head Teacher, School Director, and School Bursar.)

Fintech Uganda: FutureLink introduces Sacco dashboard to ease lending in Uganda

Kamwokya-based FutureLink Technologies last week launched the first-ever Sacco Industry Dashboard and Credit Score in Uganda.

The automated dashboard enables a Sacco or microfinance Institution to perfect its growth strategies and create new relevant financial products, by leveraging real-time comparative data from the industry.

On the other hand, the Sacco Credit Score is a tool developed to facilitate quick lending decision-making for Saccos and microfinance institutions.

Speaking at the launch ceremony on May 24 at the Grand Global hotel in Makerere, the founder and chief executive officer of FutureLink Technologies, Vincent Tumwijukye stated: “The Sacco Industry dashboard will accelerate the creation of more relevant and affordable financial services for our people, promote fair pricing, and build a sustainable and inclusive financial system in Uganda”

Richard Byarugaba, the executive director finance, Bank of Uganda, said; “I have learnt that the Sacco dashboard enables real-time industry comparison while preserving the data privacy and integrity of each institution and individual. Bank of Uganda supports such innovations that stimulate access and usage of formal financial services.”

On her part, the executive director of Uganda Microfinance Regulatory Authority (UMRA) Dr Edith Namugga Tusuubira praised FutureLink Technologies for its commitment to drive the creation of more relevant and affordable financial services.

ABOUT FUTURELINK TECHNOLOGIES

FutureLink Technologies is a community-driven marketplace for financial services that enables the unbanked and underserved customers to access and choose relevant and affordable financial services provided by a growing network of Saccos and microfinance institutions on the Msacco platform.

The Kampala Capital City Authority (KCCA) has launched the Kampala Smart City Village Ambassadors Forum, an initiative designed to aid the transformation Kampala into a modern, efficient metropolis.

Themed “Promoting the Smart City Agenda for Effective Service Delivery,” the launch event took place at Kitante Primary School on Saturday, marking a significant milestone in encouraging community involvement in the city’s development.

The Smart City Ambassadors are voluntary, patriotic community members drawn from Kampala’s five divisions: Kawempe, Rubaga, Makindye, Nakawa, and Central Division.

These ambassadors represent a novel approach to urban management, emphasizing grassroots involvement and collective responsibility to ensure the provision of quality services across the city.

Dorothy Kisaka, the Executive Director of KCCA, underscored the importance of the Kampala Smart City Village Ambassadors Forum in empowering residents to actively participate in the city’s development.

“Our goal is to transform Kampala into a more efficient, livable, and sustainable city,” Kisaka stated. “With 857 villages in Kampala, these ambassadors will serve as the eyes and ears of KCCA within their communities, maintaining cleanliness, promoting safe neighborhoods, and fostering responsible waste management among others.”

In a passionate call to action, Kisaka urged all residents to embrace the Smart City agenda and become ambassadors of this transformative vision.

“This is a voluntary call. If you want to see the city clean and growing, be a smart city ambassador. We are all building a smart city together,” she emphasized.

Kisaka also highlighted that while this initiative transcends political lines, it aligns with the NRM government’s manifesto for 2021-2026, which aims at transformingKampala and Uganda at large.

Kisaka commended the government for its financial support, which has been crucial in developing the city.

“The government has provided us with more funding to build roads and support various projects within the city,” she noted, emphasizing the need for comprehensive development to meet the needs of Kampala’s growing population.

She stressed the vital role of community participation in realizing the smart city vision, saying, “The city is big, and we need everyone’s involvement.”

Elaborating on the pillars underpinning the smart city concept, Kisaka identified three core areas: Technology, Infrastructure,

Uganda Development Bank Emerges Best Bank of the Year at East Africa Awards.

Uganda Development Bank (UDB), the country’s national Development Finance Institution, was on Wednesday named the Regional Bank of the Year – East Africa at the Annual African Banker Awards.

Now in its 18th edition, the prestigious African Banker Awards celebrate the achievements of individuals and institutions that have contributed significantly to the growth and development of Africa’s banking sector over the past year. This year’s awards ceremony in particular saw Development Finance Institutions (DFIs) triumph. They emerged as the stars of the show in both institutional and individual recognition categories, underscoring their integral role in the African financial ecosystem.

According to the event organizers, the judges awarded UDB ‘Regional Bank of the Year – East Africa’ because it showed leadership in every category required of a hugely progressive development bank, making significant contributions in uplifting the lives of Ugandans whilst weathering extreme external shocks, and extending socially and economically supportive lending that improved institutional reach and performance – yet still put powerful green and sustainability strategies at its heart.

“We are honored to receive this coveted Award, particularly considering the high-caliber recipients who have received it in the past. Being named Regional Bank of the Year – East Africa is a testament to hard work, dedication, and resolve to not only accelerate financial inclusion in the country but also facilitate Uganda’s socio-economic transformation,” Ms Patricia Ojangole, the Managing Director of UDB said at the Award Ceremony that was held in Nairobi, Kenya.

This Award is given to a bank operating either across a specific region or in one country within a region (North, East, South, West, or Central Africa). The winner will have excelled in the banking industry in the region by reaching out to new customer segments, offering innovative products and services, adopting inclusiveness by bringing the unbanked into the banking space, making use of new technologies, and contributing to a stronger financial sector.

UDB also received a Silver Award (A+ rating, under the category of Best Performing DFI) for adhering to the strict prudential guidelines of the Association of African Development Finance Institutions (AADFI), which assess operational efficiency, governance systems, development impact, and overall institutional sustainability, amongst African DFIs. UDB was one of only five institutions on the continent rated A+ and above.

“An A+ rating by AADFi reflects the Bank’s commitment to excellence and its dedication to promoting sustainable socio-economic development in Uganda. The Bank has demonstrated its strong commitment to meeting the highest standards of performance. We’re excited for 2024 and beyond, with our endeavors inspired by innovation and our commitment to excellence,” Ms Ojangole said while receiving the Award earlier in the day.

The Association of African Development Finance Institutions (AADFI) Peer Review is a rigorous evaluation process that assesses the performance of African DFIs against the Performance Standards for Green and Inclusive Recovery-oriented Services (PSGRS). UDB was assessed on key areas such as governance, risk management, financial management, and impact assessment, among others.

UDB has embraced a holistic sustainability approach, undergoing a comprehensive review of its operations. The Awards come as an authentication of the Bank’s critical role in enhancing the country’s development agenda in alignment with the government priorities.

“I take this opportunity to thank the government, Board, Management, and staff of UDB for their unwavering commitment towards the growth and success of the Bank,” Ms Ojangole concluded.

Uganda Development Bank Limited (UDB) is the country’s national Development Finance Institution (DFI) with a mandate to accelerate socio-economic development in the country through sustainable financial interventions, both debt and equity. UDB also offers non-financial services including business advisory and project preparation geared at fostering investment readiness in enterprises. Consistent with this mandate, the Bank supports projects within the private sector that demonstrate the potential to deliver high socio-economic value, in terms of job creation, improved production output, tax contribution, and foreign exchange generation, among other outcomes. These projects fall within the key priority sectors of our economy and are in line with Uganda’s development priorities.

UDB aligns its priority sectors with the National Development Plan III (NDP III), focusing on Agriculture, Industry (to include agro-industrialization, manufacturing, knowledge-based industries, and extractives), and Services (health, tourism, and hospitality, education, science, technology, and innovation) and Infrastructure. Agriculture, agro-industry, and manufacturing constitute about 75% of the Bank’s portfolio in alignment with the government focus under NDP III and Vision 2040.

Events Management: Meet Ms. Nabuuma, the maestro driving premier public events in Uganda

Her work then as the events manager at Vision Group and her meticulous attention to detail put JOWERIA NABUUMA at the frontline of events management in Uganda. When you mention events management, Nabuuma’s name somehow props up.

Even for events where she is not the poster manager, she’s somewhat somewhere in the background pulling some strings to make it work. As Frank Kisakye writes, it was, therefore, no surprise that her recent second edition of the Baby and Kids Expo received such good plaudits for the class and organisation it exuded.

You may not have seen her physically but chances are high that, she at some point, managed your company’s or agency’s event through a proxy or virtually. Her expertise is now sought after in Rwanda and Kenya as well. Under her management, events such as Vision Group’s Coca-Cola Rated Next talent show, Bride and Groom Expo, Twins Festival, Toto Festival, Harvest Money Expo, Pakasa Forum, and Embuutu y’Embutikizi all reached their peak popularity and became staples on Uganda’s festival and expo calendar.

Her Baby and Kids Expo made a triumphant return to UMA show grounds Lugogo from May 10 to May 12, 2024, after a five-year hiatus. Encouraged by the positive feedback from children, exhibitors, parents and vendors, Nabuuma is determined to make the expo an annual event, promising an even bigger and better edition in 2025.

As an expecting mother back in 2016, the same year she formed Kiara Events, the pain that she went through trying to prepare for her first childbirth made her dream of an expo where shopping and knowledge sharing for the expecting parents, experienced mothers and experts shared knowledge while shopping at the same time.

This year’s expo panel discussions focused on mental wellness, parenting of the current generation which seeks answers and questions every parental instruction or decision, children and parental health, among others.

For the slightly younger children aged five and below, the all-access children’s play area which had water slides, bouncing castles, toy car rides, face painting, wheel of fortune spins, floorboard draft and giant dice spins were their highlight of the expo. Pottery and painting appealed to the children aged above seven years.

For the majority of the children and parents, it was the first time they were physically touching the pottery wheel which, according to Bruno Sserunkuma, who has taught art for more than 30 years at Makerere University’s Margaret Trowell School of Industrial and Fine Arts, the oldest art school in East Africa region, instigates and stimulates the children’s creativity, curiosity and excitement, teaches them distress tolerance and encourages patience. Sserunkuma says this is perfectly in line with the government’s realignment of lower secondary education to skills and practical-based subjects and courses.

“That experience is good and we should be encouraging this type of education where children get exposed to clay and different ideas; they touch and feel and then start to build something with all the uncertainty of how their final product will turn out to be. That is how you build creativity amongst children. Creating basic shapes relaxes their minds and keeps them busy, and helps them to understand their environment and surroundings,” Sserunkuma said.

Elisha Betty Lukwago, 4, unlike her agemates who were more interested in the bouncing castles and water slides, spent most of her time at the Tonda World stall where there was crafting and painting. She said she loves “painting and wanted to paint something with very beautiful ears and lipstick for my mummy”

Liz Nazziwa, proprietor of Tonda World, said her craft and painting stalls were popular with the children because such art spaces and accessories are not readily available in the country yet for every human being, there is always an artistic and creative element within and many never get the chance to practically put this element to use.

“Children love colour, they love to imagine, they love to create; [Tonda World] was a space for them to play with colour and it had unique canvases, we cut for them ready characters like cars, butterflies, bees, and princesses, we had a range of things to choose from. Things they see on TV and colour them the way they want, that really motivates and excites them. Even mixing of colours that they already know and they turn into something else also excites children who are drawn to colour and it’s a way of relaxation.” she told The Observer.

Diana Kajumba, the proprietor of Kids Nook Store, another exhibitor, said this year’s Baby and Kids Expo was the first one where she has exhibited and was impressed by the quality and class, and attendance numbers.

Kajumba said though sales were not her main target at the expo but, rather, exposure and capturing the next potential customer, she made good sales as well and has no complaints.

“The attendance was also good, given what was happening, the census, concerts and the like; this expo has the potential to be bigger and better. The disappointment was that other shops didn’t come. Next year, we should have like 50 to 100 baby shops. The more of us, the merrier, then customers are able to compare quality, and variety and know why we price the way we price,” she said.

“My highlight of the expo was that for every 10 people who came at the expo, at least four knew us and for me, that spoke and told me that we’re doing something right. The order at the expo was just perfect; Kiara Events really put up a show. There were small hiccups here and there, but I talked to other exhibitors and we all have the same feeling that what was promised is what we got. I have been to several exhibitions and I think this was the most orderly one. I got the chance to talk to the customers and convince them. A convinced customer is better because you know they will eventually come to your shop someday,” Kajumba said.

BREAST MILK DONATION ‘SURPRISE’

The expo also highlighted an unexpected aspect: breastmilk donation. The state minister for Gender, Labour, and Social Development in charge of Children and Youth Affairs, Balaam Barugahara, along with many attendees, were surprised to learn about the importance of breastmilk donations.

Atta BreastMilk Community and MAA Lactation Centre emphasized the need for mothers with excess breastmilk to donate, underscoring the well-documented benefits of breastfeeding for at least two years. Atta works with several government hospitals where mothers with excessive milk can reach out and donate to the lactation centres.

GHETTO KIDS EXCITEMENT

The Ghetto Kids, formerly known as Triplets Ghetto Kids, have garnered a global fan base, appealing to all age groups and races; little wonder that the Baby and Kids Expo wisely made their performances the daily entertainment highlight of the three-day event.

Both children and parents eagerly awaited their arrival and performances, watching with keen interest and attention. The Ghetto Kids’ ever-present smiles and unique dance styles were truly a sight to behold, adding a special charm and energy to the expo.

PM NABBANJA URGES UTILITY PROVIDERS TO SPEED UP RELOCATIONS FOR KAMPALA ROADS

Prime Minister Rt Hon Robinah Nabbanja has issued a stern directive to utility service providers, urging them to expedite the relocation of service lines to ensure the timely completion of vital road construction projects in Kampala

During her Thursday tour, Nabbanja inspected the Kyebando Ring Road in Kawempe Division, as well as 7th Street and 8th Street, identifying critical issues such as right-of-way acquisition and delayed service line relocations as major bottlenecks.

These are some of the roads being constructed under the Kampala City Roads Rehabilitation Project (KCRRP).

Nabbanja called on key utility providers, including Umeme, National Information Technology Authority (NITA-U), National Water and Sewerage Corporation (NWSC), and the Police, to enhance their coordination and speed up the shifting of service lines to prevent further delays.

Expressing frustration with the current pace of progress, Nabbanja demanded immediate action from contractors and consultants.

“Let the contractor start work; we are tired of potholes,” she declared, pledging to closely monitor the situation. “I’m going to start passing here every day. If there are any problems, I want to know about them immediately.”

Highlighting her determination to ensure efficient project completion, Nabbanja announced plans to engage the Ambassador of China.

She criticized the apparent negligence of the consultants, stating, “We feel there is negligence on the side of the consultant. We are tired. We don’t want to waste even one minute. People are suffering.”

Stressing the importance of timely and high-quality execution, Nabbanja warned against any form of sabotage to government efforts.

“When we are given work, let us deliver it. Don’t sabotage government. We want to serve our people. We need quality work and quality roads,” she emphasized.

Following her inspections, Nabbanja convened a meeting with contractors, consultant utility service providers and the Kampala Capital City Authority (KCCA) to address the challenges hindering road construction.

Government Chief Whip Hamson Obua who had accompanied the Prime Minister during the road tours attended the meeting echoed her concerns, proposing subcontracting as a solution to accelerate the work.

“For us, we want to see Kampala roads in good shape. Why don’t you subcontract more so that work moves fast?” he suggested.

The tour and meeting also included the Minister of Kampala Capital City and Metropolitan Affairs, Hajjat Minsa Kabanda, and the State Minister for Kampala, Kabuye Kyofatogabye who acknowledged that the current pace of execution is a significant challenge.

The KCCA Executive Director Dorothy Kisaka, her Deputy Eng David Luyimbazi were also part of the road tours.

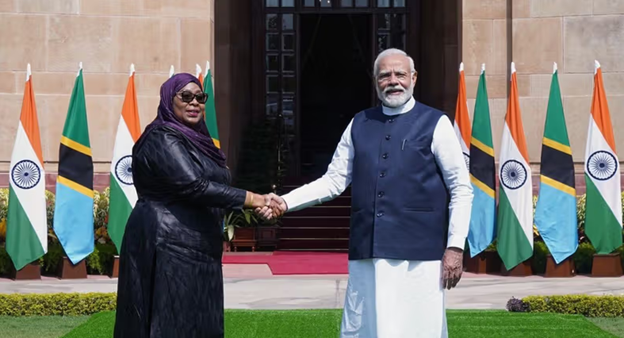

Tanzania beats Nigeria to become India’s second largest African trading partner.

Tanzania’s trade with India has grown at a very impressive pace, growing over 20% during the fiscal year. The East African country is inching closer to becoming India’s largest trading partner in Africa. Tanzania ousted the West African economic giant, Nigeria, to become India’s second-largest African trading partner.

The Tanzanian newspaper, The Citizen reported that Tanzania has edged Nigeria to become India’s largest trading partner. They are India’s second-largest trading partner in Africa, second only to South Africa.

The report cited the statement from the High Commission of India in Dar es Salaam, revealing that trade between Tanzania and India increased by 22% in the last fiscal year. Their bilateral trade value went up from $6.48 billion in 2022/23, to $7.9 billion in the year leading up to May 27, 2024.

This meant that Tanzania had moved past Nigeria which was previously India’s second-largest African trading partner and has taken the country’s place.

Additionally, the trade gap between both countries closed up significantly, as Tanazania’s trade to India increased by 25.9% to $3.29 billion.

“The latest trade statistics reveal not only an increase in the volume of bilateral trade but also an improvement in the trade balance,” the High Commission disclosed.

Pigeon peas, avocados, and Cashew nuts are some of the products Tanzania sells to India, while it buys petroleum products, industrial machinery, and automobiles amongst other things from India.

“The burgeoning trade between Tanzania and India underscores the mutual commitment to fostering economic growth, enhancing cooperation, and unlocking shared prosperity,” the embassy stated.

This growth is in line with the revealed to the attendees of the Tanzania/India Business Forum by Mr. Manoj Verma, an official of the Indian High Commission in Tanzania, back in March.

Then the High Commission disclosed that trade between India and Tanzania is expected to exceed $7 billion this fiscal year.

Trade between India and Tanzania dates back centuries ago when both people made contact with each other.

FILE PHOTO: Kenya’s President William Ruto talks during a Reuters interview on the sidelines of the IDA for Africa Heads of State Summit at the Kenyatta International Conference Centre (KICC) in Nairobi, Kenya April 29, 2024.

May 23 (Reuters) – U.S. President Joe Biden and Kenyan President William Ruto on Thursday announced investments in green energy, education and health manufacturing in the East African nation and a plan to reduce its debt burden.

Ruto arrived in Washington on Wednesday as part of a three-day state visit that includes bilateral talks with Biden on Thursday, followed by a state dinner in the evening. Ruto’s trip is the sixth state visit hosted by the Biden administration and the first for an African president since 2008.

Here are the key announcements:

DIPLOMACY

Biden will designate Kenya as a major non-NATO ally, making it the first sub-Saharan African country to receive the designation, a senior U.S. administration official said. Currently, 18 countries are designated as non-NATO allies, including Israel, Brazil and the Philippines.

The alliance – which is not a mutual defense pact – will bring some additional U.S. aid, including a new $7 million partnership to help modernize Kenya’s National Police Service, with a focus on staff and training development.

DEBT AND FINANCE

The two countries launched the Nairobi-Washington Vision, a call to the international community to help debt-laden countries like Kenya manage debt while investing in economic growth. It calls on international financial institutions to provide coordinated packages of support and on creditor countries to provide forms of debt relief.

The U.S. will soon make available lending of up to $21 billion to the International Monetary Fund’s Poverty Reduction and Growth Trust to support the poorest countries.

TRADE AND INVESTMENT

Microsoft MSFT partnering with United Arab Emirates-based artificial intelligence firm G42 to invest $1 billion in a data center in Kenya as part of its efforts to expand cloud computing services in East Africa. The data center, which will be built by G42 and its partners, will be powered by geothermal energy and provide access to Microsoft’s Azure cloud computing platform through a new cloud region for East Africa.

The U.S. International Development Finance Corporation announced it plans to open an office in Kenya’s capital Nairobi, playing a key role in driving its efforts across key sectors in Kenya such as agriculture, health, e-mobility, and energy.

The U.S. Agency for International Development will provide $15 million for new activities designed to reduce poverty and malnutrition and address global food security by expanding investment opportunities.

CLIMATE

The two countries launched the U.S.-Kenya Climate and Clean Energy Industrial Partnership. The U.S. and Kenya plan to work with international financial institutions and multilateral trust funds to identify mechanisms for mobilizing investment for clean energy manufacturing and services.

Virunga Power, a U.S. company and partner in the Power Africa effort to double access to electricity in sub-Saharan Africa, announced a pipeline of six hydropower projects in advanced stages of development in Kenya. With a total expected investment of $100 million, those projects will be built in sequence over the next five years and are expected to provide 31 megawatts of clean, renewable energy.

A $60 million grant from the Millennium Challenge Corporation will fund a four-year program focusing on the transportation needs of underserved groups in Kenya, safer options for women and pedestrians, and climate-friendly public transportation.

Credit: Reuters 2024.

Bank of Uganda (BOU) has allayed fears that some banks in the country are at risk of failing due to the recent tightening of regulatory requirements, saying that currently, all regulated financial institutions are stable.

Speaking at the opening of NCBA bank’s fifth branch in the country at Namanve Industrial and Business Park, Hannington Wasswa, director of commercial banking at BOU, said the regulatory regime was reformed to make the industry stronger, having learned from the effects of previous shocks.

There have recently been fears that some institutions might close down or be acquired mainly due to the increase in minimum capital requirements, and stricter vetting of top management personnel of banks. Wasswa hailed NCBA Uganda for its high levels of compliance with the requirements that have seen it grow its presence and performance fast.

He encouraged the industry customers to always look out for new developments in the regulatory regime and take advantage of the financial literacy programs offered by BOU to make informed decisions to avoid making losses or consuming hazardous products.

The bank has a presence around East Africa with a total of 141 branches and an asset base of Shs 1.2 trillion, making it one of the biggest in the region. Wasswa hailed the company’s innovativeness and ability to adapt quickly to changes in the business environment, including introducing services and products that respond to customer requirements.

NCBA Group managing director, John Gachora, warned that the global banking industry was operating in an increasingly hard environment, especially due to geopolitical developments and politics in some major countries.

He expressed uncertainties over the outcome of the US elections which, having featured the same candidates in a violent post-election period four years ago, could have worse effects on the economy than then. There are also oncoming elections in the UK, but the other major risks come from the persistent and potentially more explosive conflicts in Eastern Europe and the Middle East.

However, in the coming elections in East Africa, including in Uganda in two years, Wasswa expressed confidence in minimum effects on the business environment. Wasswa admitted that there is a risk to the business environment coming from geopolitics and well as the growing threat of cyber security, among others.

He urged the banks to ensure they remain above these by continuously upgrading the operational and security systems but also to keep the customers informed of new developments. NCBA Uganda made a profit after tax of Shs 28 billion last year, which the Bank of Uganda and the bank’s board have hailed as commendable, being a fairly new player in Uganda.

Mark Muyobo, NCBA Uganda managing director said they chose to open a branch in Namanve after realizing that the place, both the industrial park and the surrounding community were quite underserved. But, he added, that the bank’s core business includes industrial banking and asset financing, which are a key aspect of the manufacturing industry.

While the traditional banking hall is disappearing as digital and online banking takes over, Muyobo said theirs is a hybrid one that offers all the modern digital banking services, in addition to platforms like agency banking that give them a presence in all areas.